Transforming the finance business function

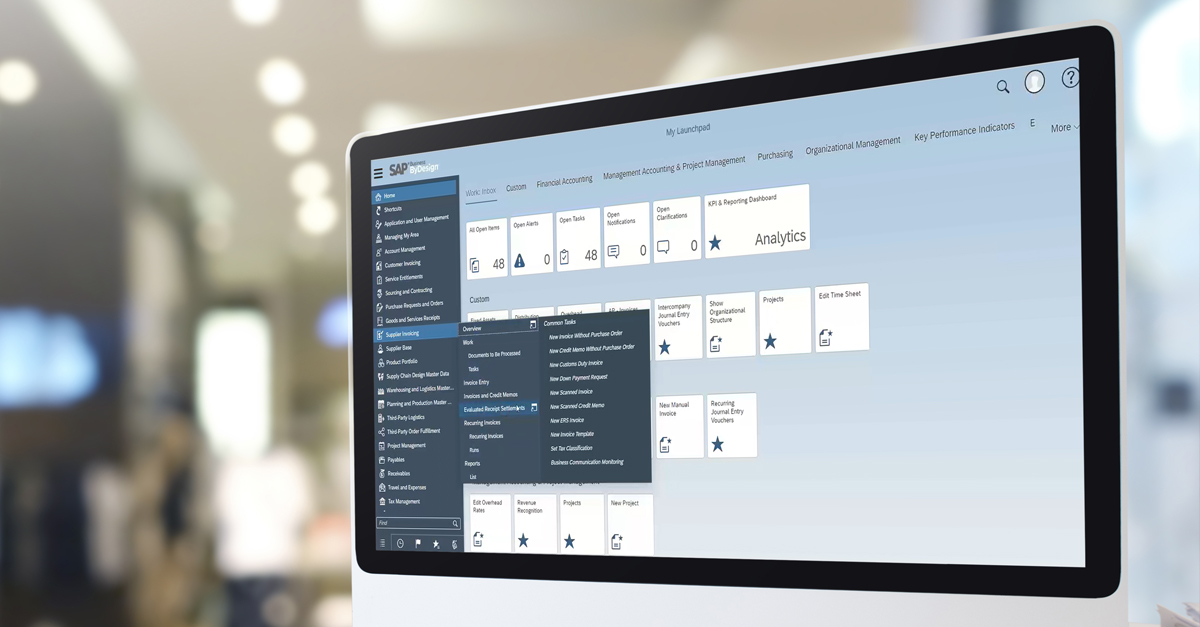

Following up from our last post on the topic An introduction to SAP Business ByDesign for middle market, we promised to go beyond the orientation and dive deeper into analytics within Finance. Recall that SAP Business ByDesign is a single cloud-based ERP solution designed to help mid-sized businesses scale and compete more effectively. Diving deeper into Customer Receivables Aging, we’ll showcase just how precise you can get when comes to the debits and credits.

Deep dive into analytics: Customer Receivables Aging

Starting from the Dashboard of key performance indicators (KPIs) relevant to Finance, you’ll notice that Customer Receivables Aging is highlighted in red, indicating that it’s not adhering to the threshold of $350,000 or less that has been established by the organization. This red alert is flagged at both the executive and the collections clerk or AR clerk level to begin strategizing what to collect first.

Looking at the aging buckets detail, the 120+ day bucket has the highest balance. The collections clerk or AR clerk responsible for following up on receivables can now go into that bucket and evaluate which customers comprise the majority of that balance, perhaps choosing to then put a block on their accounts.

The collections clerk can then analyze the business partner or customer master data record – which represents a 360° view of the customer – to see which invoices are involved and everything outstanding. You can actually segment this particular report into a format that is most useful. For instance, you can go into the underlying report definition, indicate that you want to see the underlying data table, and add a couple of fields to the report: business partner and invoice ID. You can then add a due date and bring the key figures to the column level for a neat display. Then, add a total at both the customer level and report level by navigating to characteristic settings.

The result? A report that shows information by customer, by invoice, the due date, and in which logical bucket the invoice falls. You can dive deeper into any of these invoices, the customer record itself, and more.

You can now save the report so that you don’t have to perform the same configurations the next time around. More importantly, you can share the report in a variety of contexts such as an email attachment or via an email link (provided the recipient has authorized access), for example. Additionally, you can download the report into a CSV format, linked as a data source – meaning that you can open the CSV file in the future, click refresh, and have the aging data populate the CSV file with live information.

Then, of course, you can navigate to Microsoft Excel. There's a Microsoft add-in that comes pre-delivered with SAP Business ByDesign. You can simply download it from a download center that's embedded in the tenant, allowing you to segment the data exactly how you would in the actual system.

Complete document flow: Breadcrumb trail

Turning our attention to the business partner record for any one of these companies on the report, you can dive deeper by clicking on any of the blue hyperlinks. You can dig into an invoice from the Financials tab, opening the invoice for review and to discover whether payment has been received. You’ll notice that this invoice is the result of a project that the company has engaged in with that particular customer, and that it's influenced by the terms that have been negotiated within a specific sales order. If you change your “anchor” to the Payment Allocation side, you'll be able to review more detailed information. The customer invoice is actually being reconciled with an incoming check. The check is being cleared with a check deposit, and you can see that the deposit has been reconciled with the bank statement. You have the entire document flow.

In a similar fashion, changing the anchor to Sales Order, we can see that the sales order came from a quote, which came from an opportunity, which came from a lead, which was generated from a particular marketing campaign. The entire breadcrumb trail is at your fingertips.

Finally, if you navigate to the journal entry related to this same invoice, you can see that not only is it multi-company, but also multi-currency – adhering to multiple sets of books, which represent accounting principles. In this case, this one invoice has two different journal entries that can follow different accounting principles.

To summarize our deep dive analysis of Customer Receivables Aging, we started at the Launch Pad (the landing page after login, profiled in our earlier blog), opened the Dashboard, clicked on the Customer Receivables Aging KPI, drilled down to the report, clicked on a 360° customer view to investigate further, then to the invoice, and finally to the journal entry. This ease of navigation and ready access to the full document flow facilitates financial analysis to transform your finance business function.

Learn more about SAP Business ByDesign and how SAP platinum partner Illumiti applies our smarter, faster, leaner methodology to help mid-market companies optimize their operations: https://illumiti.com/solutions/sap-business-bydesign/